Mahindra Lifespaces’ Matunga Redevelopment Signals Strong Growth Momentum and Financial Resilience

Mahindra Lifespace Developers Ltd. (MLDL), the real estate and infrastructure arm of the Mahindra Group, has been selected to lead the redevelopment of a premium residential project in Matunga, Mumbai. The move adds further depth to the company’s growing portfolio in the Mumbai Metropolitan Region (MMR) and reinforces its long-term strategy of scaling redevelopment-led growth. With a gross development value of approximately ₹1,010 crore, the Matunga project marks another significant step in Mahindra Lifespaces’ expansion trajectory, backed by a strengthened balance sheet and a clear execution roadmap through FY30.

For a company with a presence across residential, integrated cities and industrial clusters, the Matunga redevelopment reinforces its intent to tap into high-value urban precincts. As redevelopment continues to emerge as one of the most important engines of growth in land-scarce markets like Mumbai, Mahindra Lifespaces’ selection signals confidence from resident societies and partners in its execution capabilities, governance standards and developer credibility.

A Strategic Addition to an Aggressively Expanding Pipeline

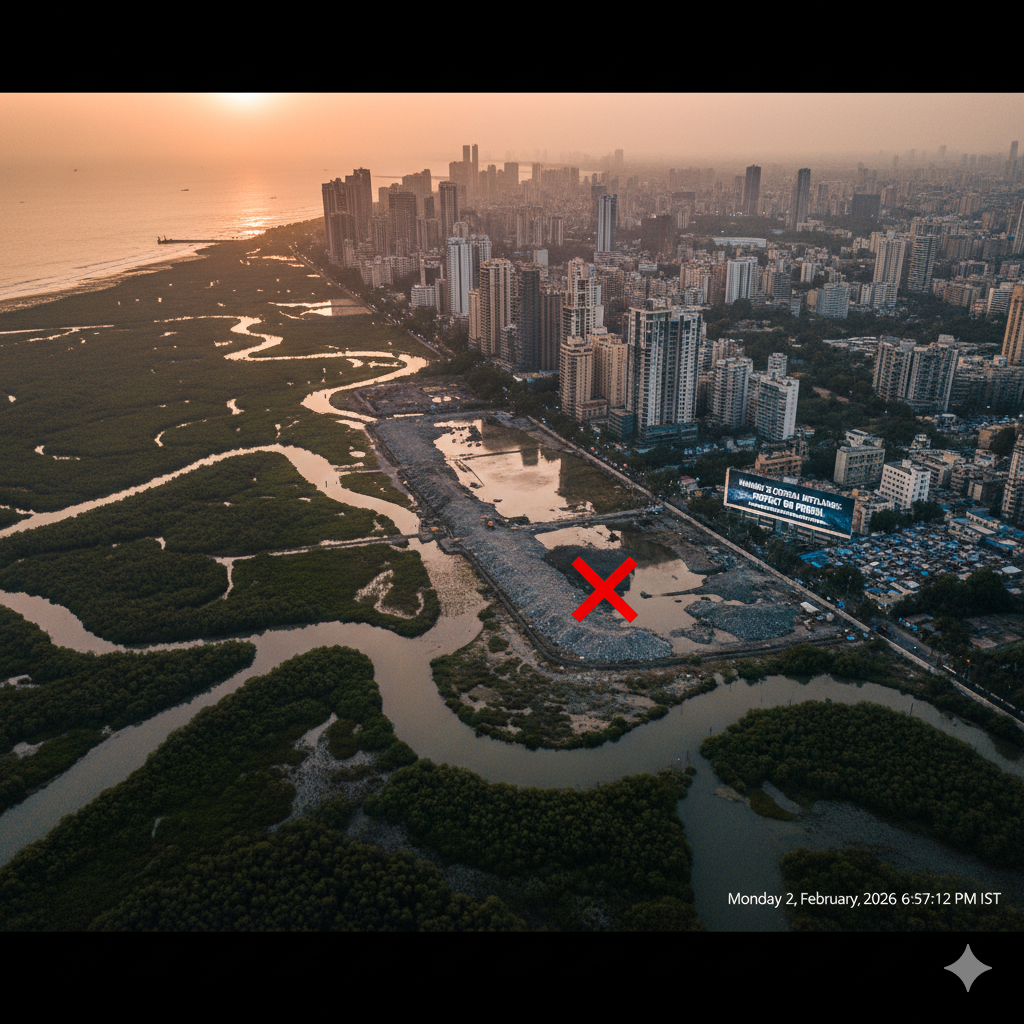

The redevelopment project spans 1.53 acres in one of Mumbai’s established neighbourhoods. Matunga, known for its strong educational ecosystem, cultural heritage and proximity to arterial routes, has seen sustained demand for premium residential upgrades. For developers, the locality offers an attractive mix of stable end-user demand and redevelopment potential, making it an important micro-market within the larger MMR landscape.

The addition of this project comes at a moment when Mahindra Lifespaces has outlined a bottom-up execution strategy anchored in aggressive future launches. According to the company’s latest investor presentation, new launches are expected to contribute between 50 and 75 percent of annual execution from FY26 to FY30. This marks a substantial ramp-up from ₹2,804 crore in FY25 to a projected ₹9,500 crore by FY30, reflecting a multi-year scaling strategy driven by both redevelopment and greenfield projects.

A Robust Launch Pipeline Across Key MMR and Pune Markets

Between FY26 and FY30, several projects across Kandivali, Malad, Kalyan, Thane, Bhandup and Pune are expected to be major contributors to Mahindra Lifespaces’ expansion. This pipeline reflects a deliberate focus on MMR, where land scarcity, redevelopment opportunities and sustained buyer demand create favourable conditions for long-term growth.

The Matunga redevelopment sits firmly within this strategy. As MMR continues to drive a major share of national residential demand, particularly in mid-income and premium categories, developers with strong balance sheets and redevelopment expertise are well-positioned to capture value. Mahindra Lifespaces’ entry into Matunga complements its ongoing and upcoming projects in suburban growth hubs, enabling a diversified presence across established and emerging micro-markets.

A Strengthened Balance Sheet Enabling Long-Term Scale-Up

The company’s aggressive growth plans are supported by a significantly fortified financial position. Following a successful rights issue, Mahindra Lifespaces’ net debt turned negative to ₹445 crore as of September 2025, compared with ₹734 crore in FY25. This shift not only demonstrates prudent financial management but also increases strategic flexibility at a time when redevelopment opportunities in Mumbai are expanding rapidly.

The company has maintained a net debt-to-equity ratio below 0.5x for the last five years. Such consistency offers considerable headroom to undertake large-ticket redevelopment projects, invest in land acquisitions and support multi-year construction pipelines. The rights issue proceeds were strategically deployed toward long-term debt repayment and acquisitions, ensuring that Mahindra Lifespaces enters its next growth phase with a clean, resilient balance sheet.

With the financial foundation strengthened, the company is better positioned to navigate market cycles, an important consideration in the real estate sector, where demand, liquidity conditions and regulatory dynamics often fluctuate.

Redevelopment as a Key Growth Engine in Urban Markets

The decision to expand redevelopment activity aligns with wider industry trends in Mumbai. Redevelopment has become a critical lever for unlocking housing supply in congested urban centres. With limited availability of greenfield land parcels, redevelopment allows developers to add modern housing stock while upgrading old buildings, improving safety standards and enhancing urban aesthetics.

For resident societies, choosing a developer with proven execution capability, strong financial backing and governance standards is essential. Mahindra Lifespaces’ selection for the Matunga project reflects confidence that extends beyond brand perception, it signals trust in timely delivery, transparent communication and long-term project viability.

The company’s emphasis on customer-centric design, sustainability and compliance also aligns well with the regulatory environment of redevelopment-heavy markets like Mumbai.

Scaling Up for FY30 and Beyond

Mahindra Lifespaces’ investor guidance points to a carefully constructed roadmap that blends disciplined execution with strategic expansion. By prioritising launches in the ₹2,000–₹10,000 crore range over the next several years, the company aims to transition into a higher growth bracket while maintaining financial prudence.

The Matunga redevelopment project will contribute not only to topline expansion but also to brand visibility in premium, centrally located micro-markets. This is essential for sustaining long-term growth in a competitive market where consumer expectations increasingly extend beyond basic amenities toward value-driven, design-forward and sustainability-oriented living spaces.

A Strong Platform for the Next Phase of Growth

With a reinforced balance sheet, a robust pipeline and a clear execution plan in place, Mahindra Lifespaces is well-positioned to capitalise on the evolving dynamics of the Mumbai Metropolitan Region. The Matunga redevelopment is a timely addition to its portfolio, offering a combination of scale, location value and market relevance.

As the company progresses toward its FY30 vision, this project highlights the broader momentum driving Mahindra Lifespaces: disciplined growth, financial resilience and a focused commitment to strengthening urban housing ecosystems across India’s most dynamic real estate markets.